Customer research and ICP definition

The worst thing you can do? Plan your marketing operations on a hunch.

How we got +250% in ICP trial starts for Toggl

“Advance B2B helped us clarify our ICP. As a result, we were also able to clarify our positioning and redefine our messaging. That has given us a solid foundation to explore different things further in all the marketing channels that we’ll be using from now on!”

Jitesh Patil

SEO & Content Specialist, Toggl

"We know our customers"

But do you, really?

If we’d gotten a dime for each time we heard this, before proving our customers wrong, we’d be about 300 dimes richer by now (that’s something!). The worst thing you can do is plan your marketing operations on a hunch. This is why we follow a strict customer research playbook to help our customers identify the most important pain points of their target audience.

Qualitative customer research to identify and solve your bottlenecks

Customer research is one of those things for which a one-size-fits-all approach doesn’t work. The reason for this is simple:

your business is unique

your challenges are unique

your customers are unique…

… and so are the reasons why they chose you. Our advanced customer research process helps us help you to:

Acquire more of the right customers

Understand the real value you provide

There’s what you think your customers get from you, and there’s what they really get.

How do your customers use your product and/or service? What features do they get the most value from, and how can you show that value to them as quickly as possible in the funnel?

Increase retention

Do you really know what pushes your customers to churn?

Our qualitative customer research provides information that can be used to improve the customer experience and reduce customer turnover.

Increase CLV*

*Customer Lifetime Value

Talking to your customers also gives us a chance to pinpoint their AHA moment — or the moment when they understand the value they can get from your product/solution and are ready to pay for it.

Our qualitative research helps you understand:

- how to turn your free users into paying customers,

- the best way(s) to increase customer value,

- cross-selling and upselling opportunities to retention and revenue.

Who is our customer research for?

Customer research is an unbelievably simple way to acquire a serious competitive edge, regardless of your core business.

All you need is a handful of ideal customers* that we can talk to. If you still don't have enough suitable current customers (pre-PMF startups, new product/market, etc.), we can also carry out the research from the customer development/validation angle.

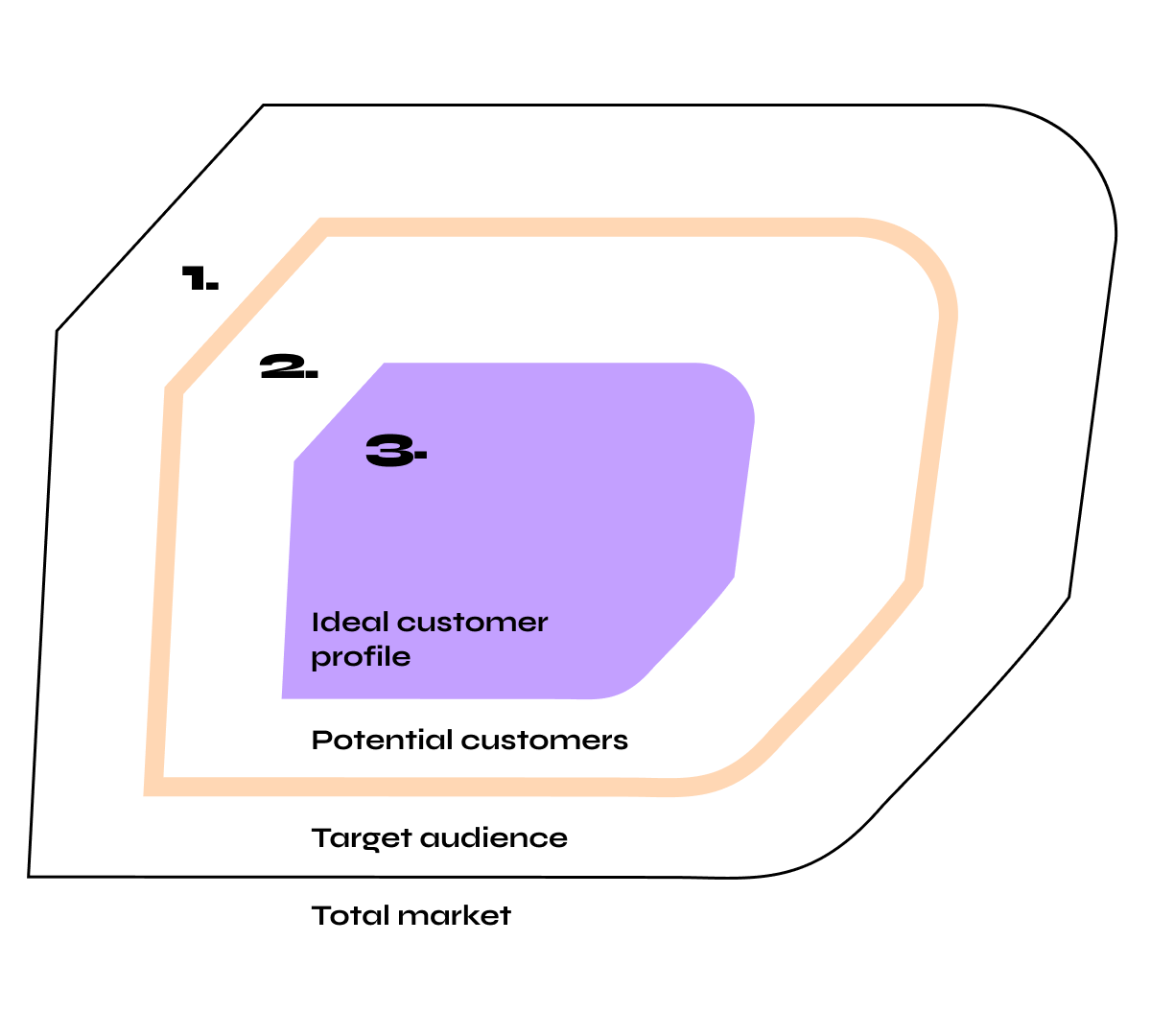

* Customers who use your product or service, are satisfied with it and don’t drive your customer success team crazy. It's easy to sell to them because they understand the value of your product or service. They also have a high customer lifetime value (LTV) and relatively low customer acquisition costs (CAC).

Our approach to qualitative customer research

#1 - Defining your ideal customer

Week 1.

We facilitate a two-hour long workshop, during which we work together to define and document what we believe is your company's Ideal Customer Profile (ICP), as well as your most valuable customer segments based on what data says and your growth aspirations.

If there are several ideal customer profiles, we recommend examining max. 2 segments at a time.

#2 - Conducting interviews

Weeks 2-4

After the ICP workshop, we create a shortlist of customers we absolutely want to talk to, and book the interviews with your help.

We typically conduct 3-5 interviews of approximately 30-45 minutes per customer segment. Interviews are conducted in either Finnish or English.

#3 - Analyzing and aggregating our findings

Week 5.

We analyze and aggregate our research findings and compile them with recommendations into a working document.

#4 - Presenting our findings

Week 6.

We then go through our findings and recommendations together and —in most cases— refine your ICP definition.

And you get all this!

- Clear understanding of who your best customers are: Refining your ICP definition is needed to align the entire company — marketing, sales, product development, customer success — around your best customers.

- Summary of key findings from the interviews: Our findings help our customers adjust their positioning and messaging, refine their sales pitch, identify relevant topics to tackle through content, refine their website copy, and much more.

- Recommendations based on the interviews: We also provide our customers with a list of concrete measures to implement to impact their bottom line sooner rather than later.

- Customer Journey Map: Upon separate request, we can also prepare a visualized customer journey to illustrate your buying process and the bottlenecks your prospects face.

ICP ≠ buyer persona

The traditional buyer persona focuses on people and demographics instead of context. This may be a hot take, but we believe that the buyer persona model is 100% worthless for B2B tech companies.

How does our customer research approach differ from other options?

We can’t argue against the simple fact that we aren’t a proper consumer research company. We’re not scientists; we’re B2B marketers.

However, this gives us a significant advantage over research companies; we understand your problems. We can turn the information we get from your customers into actionable insights that you can then implement to grow your business.

Brand & Market research

Brand research shows you how the market perceives your company's weight, your strengths, and weaknesses. Now, whereas brand research is quantitative research, our customer research is qualitative, and so, sometimes, the best combination is to conduct both, as they complement each other.

Market research helps to understand the competitive field and the market at a general level. It is helpful for mapping potential markets but not for understanding context-related motives when you want to know how and why your customers use your product.

Web analytics & Surveys

Web analytics, product analytics, and advertising data provide important information about what is happening and how. Qualitative customer research, on the other hand, reveals why your customers behave the way they do.

Surveys are a great way to reach statistical significance … if the sample is large enough, which is not realistic for many B2B tech businesses. What’s more, the quality of the data depends not only on the answers but also on the wording of the questions: a poorly worded question can lead to significant bias and misinterpretation of the data pool.

We’re always hungry for more data

We’ll always take and analyze all the data we can get when building and/or refining your ICP, but we believe that qualitative interviews are the only way to truly nail your ICP definition.

DIY or with a partner?

Do it yourself - Pros

- No additional costs: only your own working time and salary — which, of course, can also become a greater cost than simply hiring a strategic partner.

- No onboarding: There is no need to familiarize an external partner with your and your customers' situation

- More ownership: Talking to your own customers is the best possible way to get to know them and at the same time, build deeper relationships.

Do it yourself - Cons

- Lack of resources: Doing customer research on a project basis takes time. It is well known that there are a million other (more important and urgent) things on the in-house marketer's desk, and important but not-so-urgent tasks are deceptively easy to postpone

- Lack of experience: If you haven't done research before, routine, lack of processes and best practices will slow you down. You may not know how to ask the right questions nor detect relevant trends or patterns in the hot pile of information you receive from your customers.

- Lack of objectivity: Customers may sometimes be reluctant to really open up to a company representative and may even embellish their answers to avoid awkward discussions.

Outsourcing - Pros

- We’ve been doing this a long time: We’ve been refining our process for over 10 years. We know how to do this and what to avoid when conducting the interviews and making sense of the information we get from them.

- Receive our Know-How: We have conducted thousands of customer research interviews. When working with us, you will likely learn a thing or two. While we don’t recommend it, we understand if you’d rather conduct the interviews yourself, as it is the best way to get to know your own customers. In this scenario, we can sit in the back and assist with planning the interviews and aggregating your data.

- We fight your fights: internal politics can be tough. If and when necessary, we help you get internal buy-in and commit the most important people to doing things in a more customer-oriented.

Outsourcing - Cons

- It’s an investment: It CAN cost more than doing it yourself.

How we helped Mediamaisteri grow with growth marketing

“We started our cooperation by identifying our ICP. And from that ICP work, we realized that there was a lot of development work that we needed to do with our positioning. Advance B2B was there to help us along the entire way”.

Arttu Kotakorpi

Sales Manager, Mediamaisteri Oy

What does it cost?

ICP definition

€7,000

1 segment studied

ICP definition

€12,000

2 segments studied

Custom research

Need to study more customer segments or a combination of qualitative and quantitative research?

Let's have a talk!

Our calendar booking is the simplest way to get in touch. Just pick a time slot and book it!

Alternatively, you can fill out our contact form, and we’ll respond within the next 24 hours (unless, of course, it’s the weekend or a national holiday).

* if you're interested in working for us, visit our careers page!