Last updated 07 June, 2022.

This is a guest post by Niko Laine, CEO and CFO of Calqulate. He’s passionate about solving problems, data analysis, and bringing clarity and focus to difficult situations. With over 15 years of experience in the funds industry and SaaS and marketplace companies, Niko's your go-to person for all things B2B SaaS growth metrics.

You’ve probably heard this a lot: “Marketing needs to spend money, and finance always says no to spending money.”

While the above statement often rings true, your CFO is not doing that because “it’s part of their job”. Trust me, as a CFO, we really don’t have a clause in our job description that says “You must say ‘No’ at all times.”

We like spending money too. But we like burning it the smart way — it merely means we like to know what is the return on investment and when. When talking to a CFO, you need to present facts and data and prove your assumptions.

Once again, saying ‘No’ to spending money is not in our job description. But cash flow forecasting definitely tops the list. It’s our bread and butter. We need to know how our Profit & Loss (P&L) statement could potentially look like every month.

And psst: If you’re interested in this topic, stay tuned for more (and subscribe to our Advance Insider newsletter to make sure you won't miss any future posts! 👇)

As a SaaS marketer, here’s why you should report to your CFO:

The relationship between Marketing and Finance is possibly, and arguably, one of the most important relationships in a business.

However, there’s still the age-old conflict between Marketing and Finance. This relationship usually ends up in a rift because of silos between both departments. Silos happen when:

- You don’t share the same analytics even though you’re working towards the same goal.

- You don’t communicate clearly enough so you have a mutual understanding of cause and effect, i.e. how much marketing spend and headcount create future revenue streams.

Let’s dive a little into the role of each department. 👇

Marketing

You’ve probably heard it a thousand times and know it by heart by now — Marketing is more than just a creative department.

However, it’s also easy to lose sight of the larger picture when your days are filled with a long list of tasks such as drafting campaigns, paid acquisition, copywriting, etc. Let’s take a step back, what do you really do as a marketer?

You know it and you’re right. Your one and only mission is to make the company’s revenue streams grow. And you make it by finding the right customers.

If you’re not marketing right, you’ll most likely end up in front of the wrong audience. If you’re not in front of the right audience, you’re not converting as many deals as you should. And the few new customers you converted are more than likely to churn.

Your main Key Performance Indicators (KPIs) usually include measuring:

- Customers gained

- Customers retained

- Upselling/Cross-selling

- Customers lost

Finance

The role of this department is self-explanatory. It’s all about the money.

Your CFO’s KPIs usually also include measuring:

- Customers gained

- Customers retained

- Upselling/Cross-selling

- Customers lost

You read it right. It is the exact same set of metrics because they all impact revenue, revenue, revenue!

While your responsibility as a SaaS marketer is to find the right customer, your CFO is responsible for making sure the company doesn’t run out of money. It means they need to know exactly when money is going out and coming in — cash flow forecasting.

Your CFO is there to harness chaos and make people focus on the same goal. This is done by creating certain structures and constraints in the company. Don’t get me wrong. They’re not there to make your job difficult. Contrary to popular belief, constraints are good for innovation without shortening the cash runway. It’s a win-win situation that keeps the business going.

As we all know, cash is key to a business’ survival. You’ll never hear a CFO say: “We only have 6 months of cash runway, let’s see what happens after that.”

(We would already have at least 3 different plans in place to tackle this situation. ‘Let’s see what happens’ rarely exists in the finance world.)

SaaS growth metrics that interest your CFO

Based on the above-mentioned set of KPIs, these are the growth metrics that you should be reporting to your CFO:

Customers gained

- Monthly Recurring Revenue (MRR): Revenue is the lifeline of any SaaS business. This is the metric that your CFO will be watching like a hawk.

- Customer Acquisition Costs (CAC): The total costs needed to acquire one customer. Your CAC is more than your media spend, it also includes the salary of the people involved in the process of acquiring a customer.

- CAC payback time: This metric tells your CFO how long it takes to break even after acquiring a customer. Typically, the CAC payback time is no more than 12 months for a SaaS company.

Customer retained

- Customer Lifetime Value (LTV): The total amount a customer is worth throughout the entire duration they are with your business.

- LTV:CAC ratio: A rule of thumb for a healthy LTV to CAC ratio is 3:1. It means that the customers should be bringing in revenue of at least three times more than the cost it takes to acquire them.

Upselling/Cross-selling

- Net Revenue Retention (NRR): This metric reflects your customer retention success rate through upselling and cross-selling. The higher the net revenue retention, the better.

Customer lost

- Churn: The total number of customers who left your business. Customers churn for various reasons such as not the right product fit, mismatched expectations, pricing, etc.

Chopsticks metrics...what?

If you have come across my other articles here, you’ll know that I repeat this like a broken record: Never look at your metrics in isolation.

When you look at your metric in isolation, you run a higher risk of turning it into a vanity metric. Vanity metrics are nice to look at but don't necessarily give you the full picture. Let’s assume you’re tracking only website traffic.

You may have high website traffic but low sign-up rates because you’re not speaking to the right audience. But you won’t know that if you’re tracking only website traffic, and you can’t improve what you don’t know.

For your metrics to make sense and give you a full picture, you always need to pair them with another metric. At Calqulate, we call them ‘Chopsticks metrics’ — they are most useful when used as a pair. For example, LTV to CAC and the various sales funnel conversion rates are perfect chopsticks metrics.

Getting your CFO to say ‘Yes’: Speak each other’s language

Assuming you’ve already been reporting all the above growth metrics to your CFO, and they are still saying ‘No’ to all your budget requests. What’s the point of reporting your metrics then?

Oftentimes, it boils down to communication.

When you make a budget request or an ASK, it’s important to provide your CFO with forecastability. Remember, our job is to make sure the company doesn’t run out of money. It’s important we know where every single penny goes.

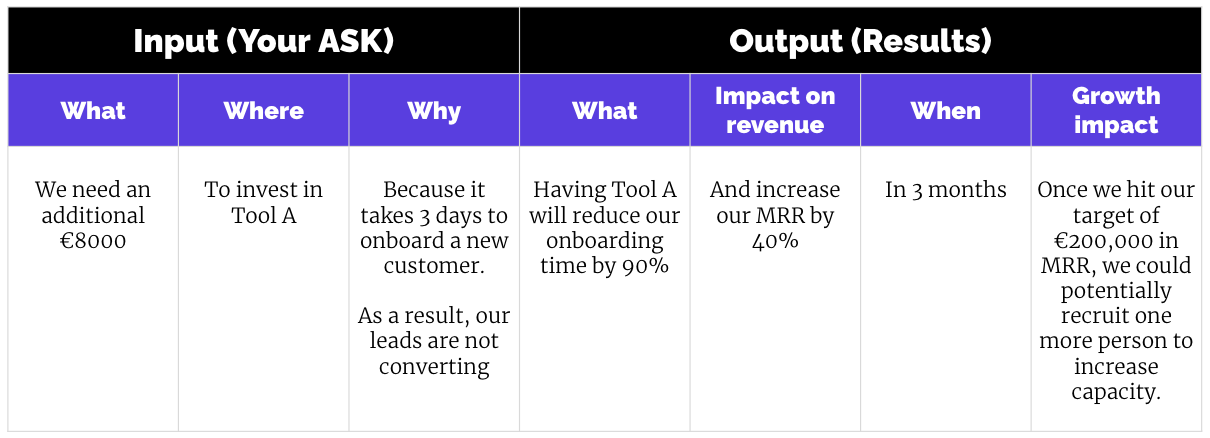

For example, assuming you need an additional €8000 for your marketing campaign.

You’ll probably go to your CFO and say, we need another €8000 to invest in this campaign because our leads are not converting. We can do X, Y, Z for €8000. This ASK will warrant an immediate ‘No’.

Now, let’s break the above ASK into the following format:

Most of the time, your CFO is refusing a budget request because they are only hearing the ‘Input’ section of your ASK. They’re more concerned about the results and impact that ASK has on the company’s cash reservoir.

Like investors, your CFO is all about the metrics and forecastability. Our biggest nightmare when it comes to budget ASK is not knowing how and when it’ll impact the company’s overall financial health.

Conclusion!

There are two things to take away from this article.

1️⃣ Your CFO is not a dragon guarding its treasures. 🐲

All they want to know is your analytics. I believe I speak for most CFOs when I say that numbers speak louder to us — louder and clearer than words. Prove that your numbers are right and there is logic behind them.

Rifts happen because you don’t understand each other’s analytics even when you’re working towards the same goal. The best way to improve the relationship between Marketing and Finance?

Report your growth metrics to your CFO to help them understand your responsibility as a SaaS marketer:

- Monthly Recurring Revenue (MRR)

- Customer Acquisition Costs (CAC)

- CAC payback time

- Customer Lifetime Value (LTV)

- LTV:CAC ratio

- Net Revenue Retention (NRR)

- Churn

2️⃣ Never look at your metrics in isolation

Always pair your metric with another metric to get the larger picture. Else, you’re running a risk of turning a single metric into a vanity metric. There are exceptions to this too. Your MRR is one of the very few metrics that can be observed in isolation.

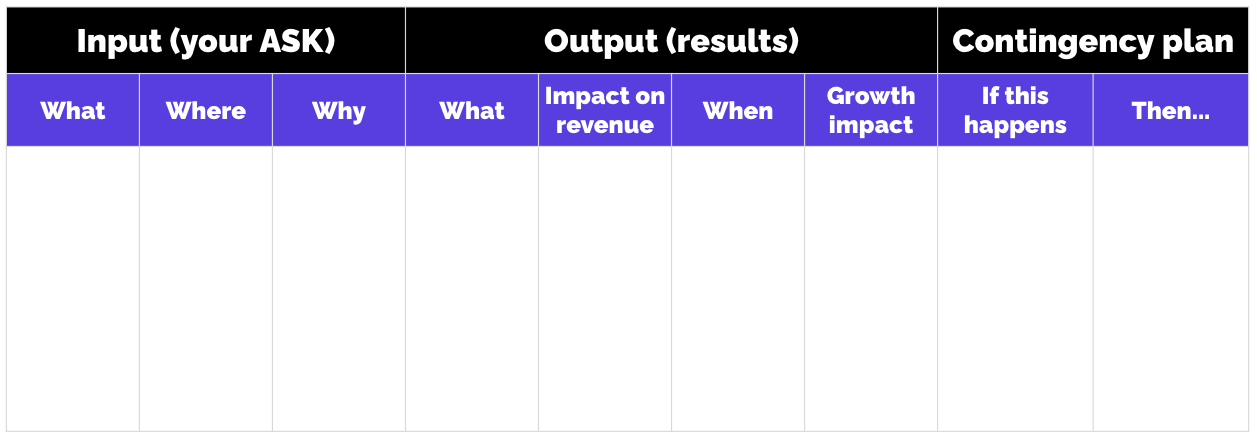

One last CFO tip from me: To increase your chances of getting a ‘Yes’ the next time you have a budget ASK, try using this format instead:

To sum it all up, cash flow forecasting is a huge part of our job as a CFO. It means the more we know, the better. And don't forget that we like spending money too — smartly.

What’s next?

Calqulate partnered up with us to get help scaling up marketing operations. What's the verdict? We've got the answers here👇

.png) Niko Laine

Niko Laine